The Ultimate Hedge

Multi-strategy funds hold one of investors’ best hopes for ROI. Could this investor appeal, combined with an advantageous operational landscape for asset managers, make the march of multi-manager funds unstoppable?

Diverse, flexible – and lucrative. In the eyes of investors, what’s not to love when it comes to multi-strategy hedge funds. As demand grows and funds compete to attract the best talent, the multi-strategy model makes good sense for portfolio managers, too.

Investor appeal

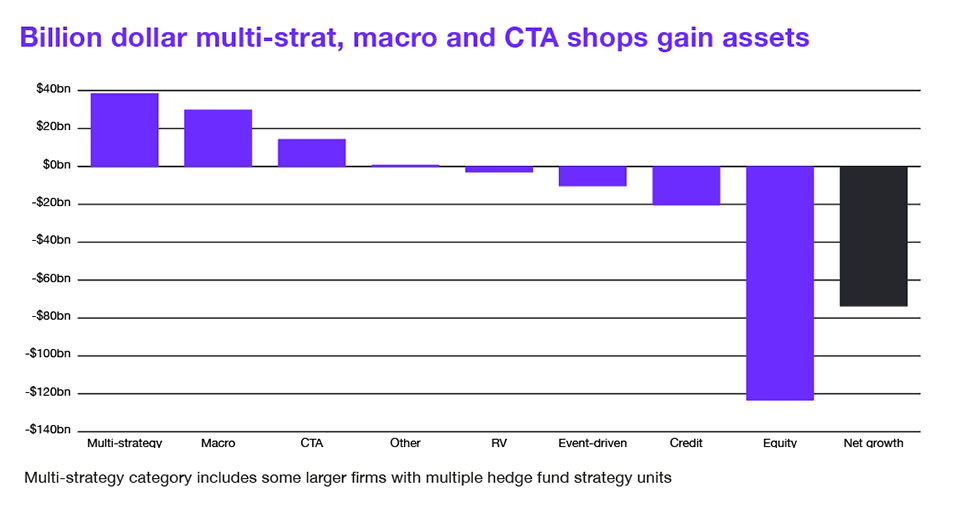

There can be no doubt that multi-strategy funds are pulling in the punters. With Intelligence Billion Dollar Club data shows a global $38.6bn year-on-year increase in AuM for multi-strategy hedge funds at the end of 2022, putting multi-strategy some $8.7bn ahead of other hedge fund strategies in terms of increasing AuM.

Source: With Intelligence data and research

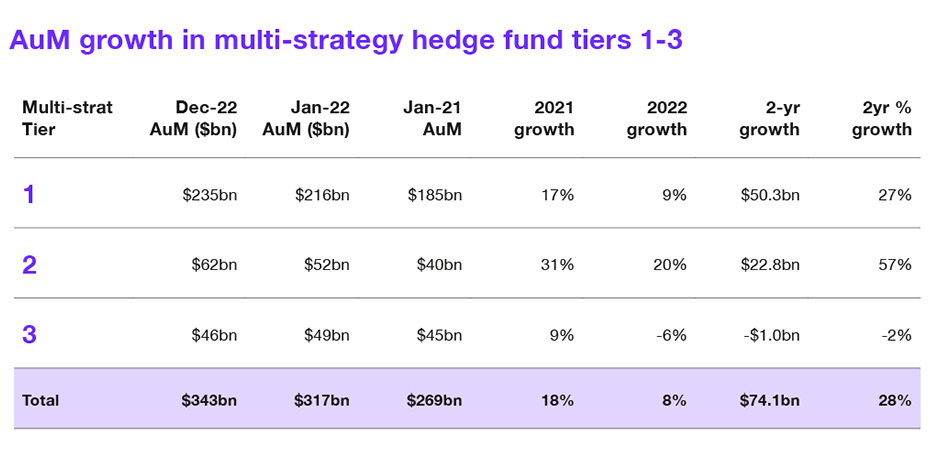

In the US, top tier US multi-strategy funds saw a 21% increase in AuM in 2022, hot on the heels of a 34% increase in 2021.

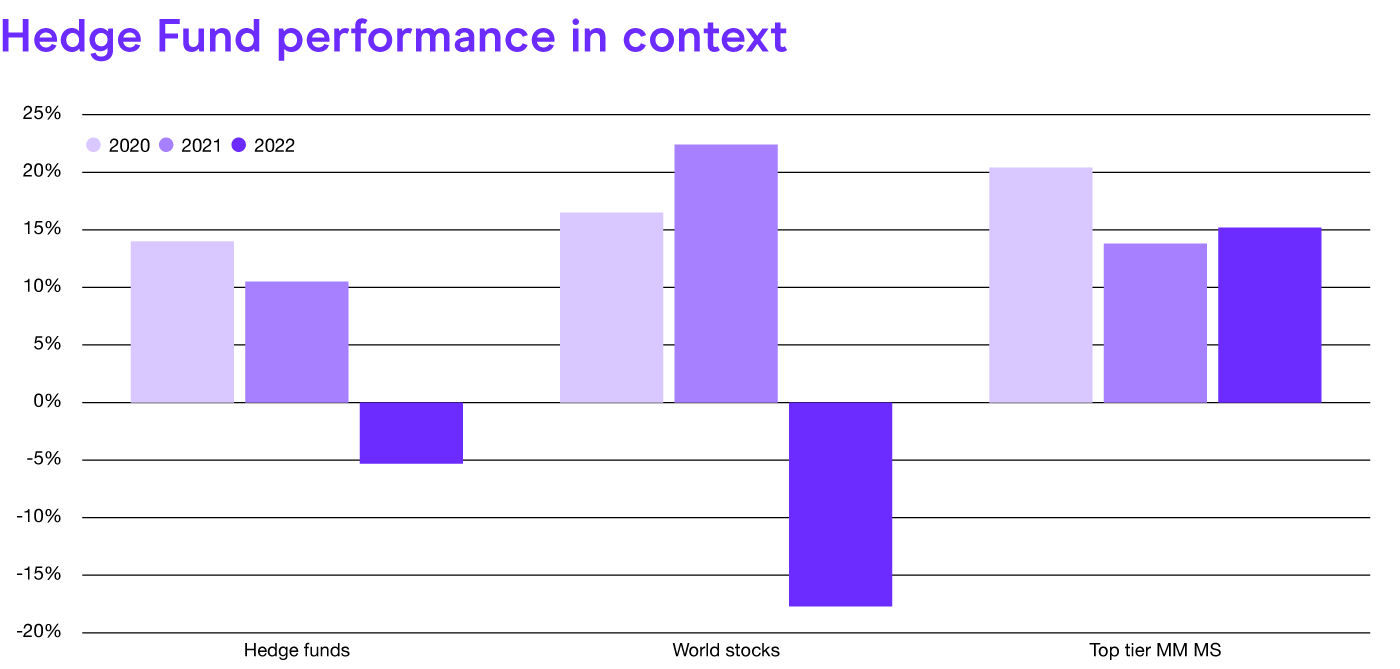

Hailed by FT as the “one style to rule them all”, multi-strategy funds offer diverse exposure and flexibility in response to market volatility – a compelling combination in the uncertain economic climate that has meant hedge funds as a whole have struggled to stay ahead of traditional markets in terms of performance.

Source: With Intelligence data and research

“It’s about maximizing dollars of risk exposure at the highest Sharpe,” says Bill Young, co-CIO at New Holland Capital, whose multi-strategy fund closed 2022 with gains of 16.9%

PM talent scout Matt Proffitt, founder of OCR Alpha, puts it simply: “Multi-strategy protects investors – and gives them the upside.”

As investors queue up to allocate, ever more ‘multi-strats’ enter the market – many genuinely diverse in their offering, while others offering narrower selections are rapidly re-labelling.

“Many of the bigger funds are now closed to investors,” says Proffitt. “They are looking for other places to put their money, which is why you’re seeing smaller platforms grow very quickly.”

bfinance Multi-Strategy Hedge Funds report uses With Intelligence data to assess the multi-strategy landscape. “There is genuine choice out there and that's actually part of the challenge,” says one of the report’s authors, head of liquid markets Toby Goodworth. His colleague, senior associate Pravir Sharma, explains: “Almost 1,000 providers self-classify as multi-strategy. Not all of them exhibit the traits you’d typically look for - multiple return drivers, multiple asset classes, diversification depth and breadth.”

Source: With Intelligence data and research

Making it pay

With a line of investors at the door, multi-strats must deliver – and for that they need a talent pipeline of the best portfolio managers.

“The bar to entry is high,” says Proffitt. “They want the senior people. But they also have internal developmental programs for managers with two to three years’ independent track record – they’re hoovering them up before they become very expensive to hire and bringing them on under a more senior individual.”

For ambitious portfolio managers who want the security of the multi-strategy umbrella - and don't relish the admin of the single-fund-manager model - there are still more incentives.

“PMs who previously might have seen 12-15% payout are now getting 20%” Proffitt says.

Unlike ‘one-book’ funds, where one portfolio manager with one pool of capital would lead a team, many of today’s multi-strats use a ‘pass-through’ model, where discrete 'pods' within the firm operate independently, each passing fees on to investors. Each pod PM has their own capital to deploy and trading autonomy.

Teamwork

That autonomy, along with higher fees, make the pod model irresistible for ambitious PMs. But whether you’re working within a pod or a one-book model, there are further benefits to being part of a wider operation.

“Opportunities to collaborate with other teams and the feeling that you’re part of a growing business are what the growing majority of investment talent are looking for right now,” says Proffitt. “More and more of the multi-strats are moving towards a more collaborative, idea-sharing environment.” And in a challenging economic climate, opportunities to share ideas and learn from other PMs are attractive even to top-notch talent.

New Holland Capital’s Young highlights the challenges of scale inherent in multi-strategy funds. “For any business model focused on delivering alpha, it’s a big challenge to scale and keep the quality of talent high. Growing fast can mean it’s a struggle to put those assets to work and repeat successes.”

Investors will be sharply focused on whether multi-strategy funds can deliver that success while, for PMs, the benefits of multi-strategy funds in the current economic climate are clear.