Top multi-strats back at least 100 managers

Share:

With research estimates total external allocations to be up to $55 billion

Leading multi-strategy multi-manager hedge funds have capital allocated to at least 100 third party managers, according to the latest research we conducted.

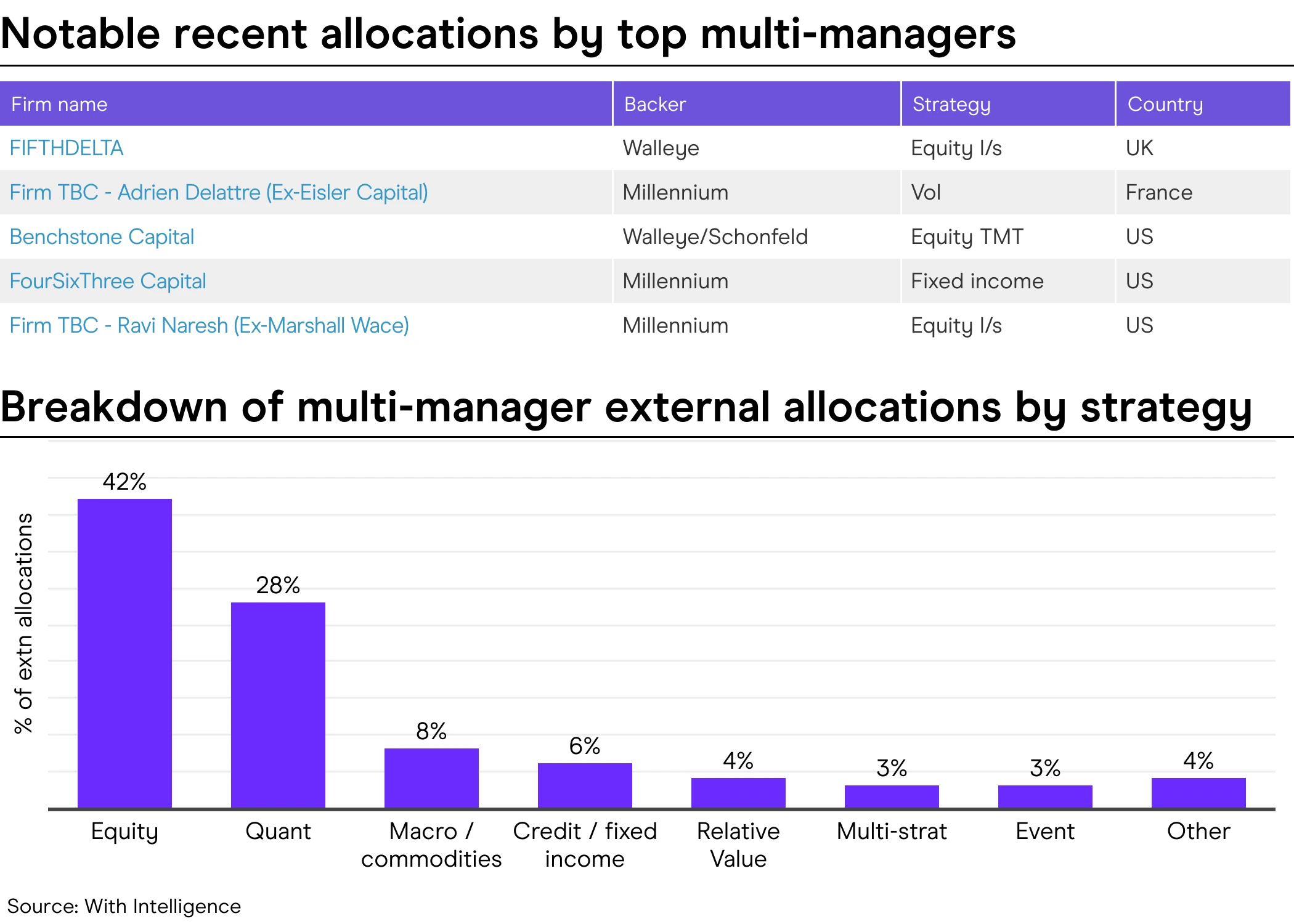

The largest firms – Millennium, Schonfeld, Verition, Point72 and ExodusPoint – have invested in at least 60 managers. Outside of the biggest players, we have tracked at least 40 more allocations made by multi-managers.

The notional assets deployed are estimated to total as much as $55 billion.

Interval Partners, Benchstone Capital Management, Oribel Capital Management, Prana Capital Management are among those with multiple backers.

Millennium is the largest allocator by notional AuM, the research shows.

The research highlights how large multi-strategy hedge funds have evolved their respective businesses to become significant sources of capital for both established and emerging managers, with tickets regularly exceeding a billion dollars in notional value.

These funds typically use external allocations to quickly gain access to strategies that they are unable to bring in-house, and as a way to avoid paying large upfront guarantees to portfolio managers at rival firms.

Based on the research, Schonfeld is the manager with the most active allocations, backing at least 27 external managers, closely followed by Millennium with 25 or more.

The two firms are well ahead of peers in terms of individual allocations.

Point72 has three and ExodusPoint and Verition have two each.

The research suggests that Balyasny Asset Management currently has no active external allocations. It was reported in recent months that the firm had redeemed from Landmark Investment Partners. Last year, the firm also pulled its capital from Sparta Capital Management.

Smaller peers, such as ExodusPoint and Verition, have decreased the number of external teams.

ExodusPoint typically backs quantitative managers, while Verition has capital invested with fundamental equity long/short and relative value strategies.

Outside of the largest multi-strats, Walleye has capital invested with approximately eight managers.

Walleye, which is understood to have invested in external managers for some time, typically allocates to equity long/short teams.

Earlier this year, the firm invested in FIFTHDELTA, an equity long/short hedge fund managed by former Citadel PMs.

The firms included declined to comment.

World-leading hedge fund data coverage

Our hedge fund dataset delivers hard-to-find, directly sourced intelligence that cuts through the noise to provide in-depth insights on investors, funds and people.

Our comprehensive platform powers a full suite of teams across the alternatives industry.

From investor relation and business development teams, through to investors and consultants, our hedge fund data ensures access to exclusive data and intelligence that empowers managers to fundraise faster and investors to allocate smarter.

This is data and intelligence you can act on, giving you the clarity to make smarter decisions, assess risks accurately, and stay ahead of the competition.