Multi-Manager: A Strategy Under Scrutiny

As the headline-grabbing performance of multi-manager funds slows this year, ever more funds are following their lead.

Multi-manager funds have been one of the biggest investment stories in recent years, emerging as an increasingly important segment of the hedge fund universe due to their ability to raise significant LP capital at a time when many other strategies are struggling.

But as a new generation of firms now seeks to emulate the success of large well-established multi-managers, pass-through fee arrangements, liquidity terms and recruitment policies have come under increased scrutiny.

Analysis of the investment returns of top billion-dollar multi-managers in With Intelligence’s latest hedge fund strategy report reveals their performance has largely lived up to the hype, with the top-tier multi-manager firms averaging 18 months of conservative gains through November.

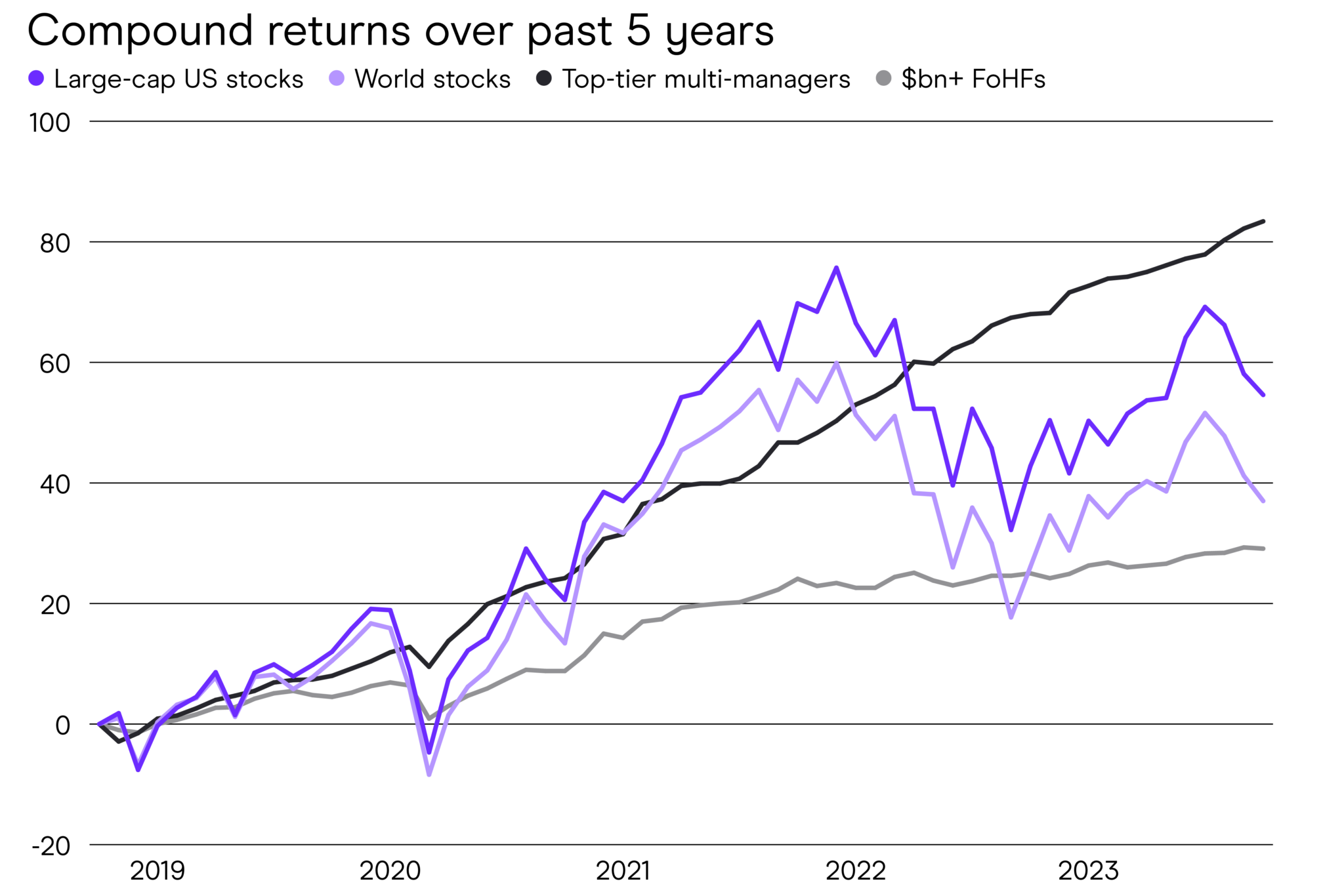

During the past five years, multi-manager funds have provided substantial protection and positive uncorrelated returns during equity sell-offs and periods of macroeconomic volatility, outperforming large-cap US stocks and bonds at a significantly lower level of volatility.

With Intelligence data also shows that these funds have, on average, outperformed both large FoHFs and global hedge fund peers over the most recent three and five-year periods.

And the largest pod-shops, which have grown significantly in recent years, have outperformed their billion-dollar peers. The top performer, Citadel, now ranks as the top earning hedge fund of all time, delivering $16bn for investors last year and $7bn this year.

A recent slowdown in performance is putting more scrutiny on multi-managers

Matt Smith, With Intelligence Hedge Fund Editor

With consistent returns, top-tier multi-managers have dropped only three months on average over the past five years, with a 12% annualized return and a Sharpe ratio of 2.4, the With report shows.

A recent slowdown in performance is putting more scrutiny on multi-managers, but their track record remains compelling for many investors.