Global Billion Dollar Club Report | H2 2023

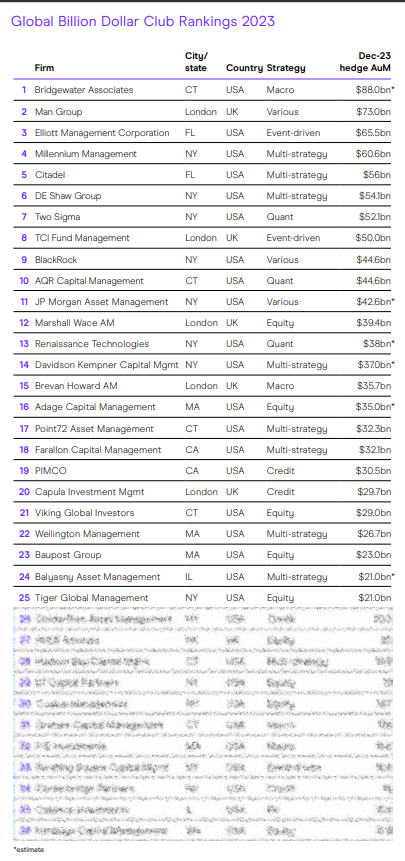

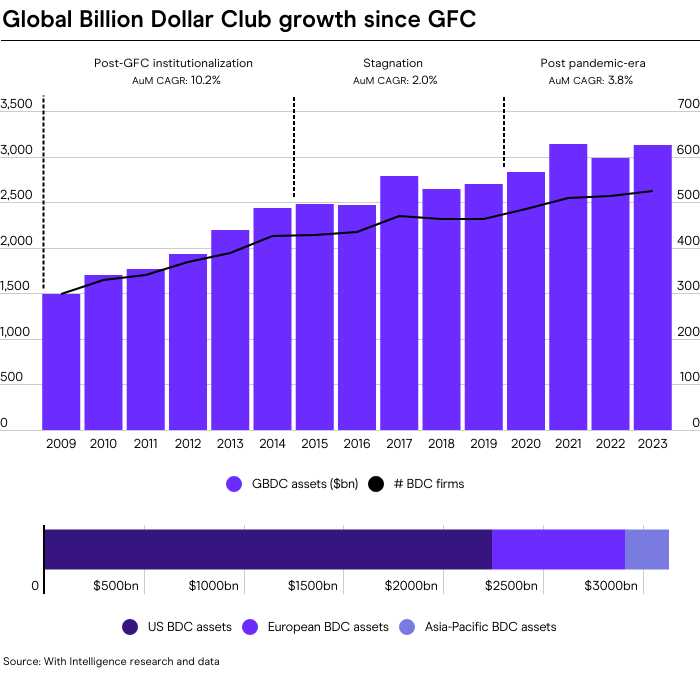

The global hedge fund industry had 524 firms managing more than $1bn at the end of 2023, according to latest With Intelligence research.

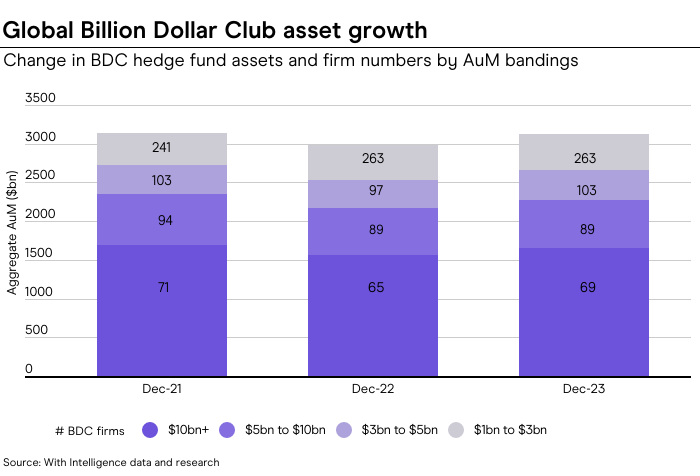

The total hedge fund assets managed by this Global Billion Dollar Club (BDC) stood at $3.13tn, nearly 5% more assets than the BDC at the end of 2022, and just below the prior $3.14tn peak for the grouping at the end of 2021. The BDC accounts for around four-fifths of total hedge fund industry assets.

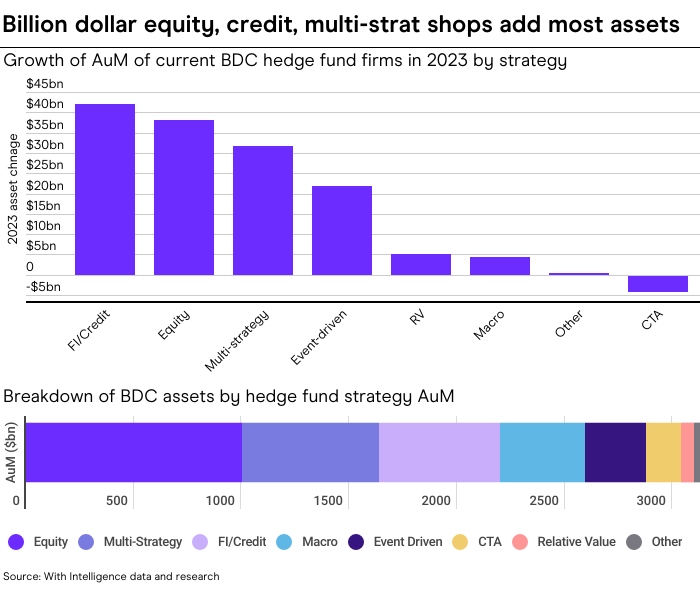

Two-thirds of BDC firms grew assets over the year. Credit and event-driven hedge funds, which were among last year’s best performers, grew at the fastest pace, increasing assets by more than 8%. Credit and fixed income firms added the most assets in dollar terms, some $44bn. Last year’s growth lifted the annualized compound growth of the BDC since Covid to nearly 4%.

However, the rise in BDC assets lagged performance-based gains as billion-dollar funds returned around 8% on average last year. They gained 3% in 2022. A typical 60/40 stock/bond portfolio advanced nearly 17% last year after losing 15% in 2022.

Overall, investors pulled an estimated $111bn from hedge funds during 2023, according to With Intelligence estimates, with long/short equity seeing $40bn of the outflows. The pace of net redemptions slowed from the net $164bn that left the industry in 2022.

The asset growth among billion-dollar hedge fund firms was driven by $10bn+ firms, which accounted for more than half of the growth. This segment of the BDC was $91bn larger than at the end of 2022, a 5.8% rise. The $3bn to $5bn segment saw the fastest growth, up 7.3%, or $26bn, on the same segment from the BDC at end of 2022.

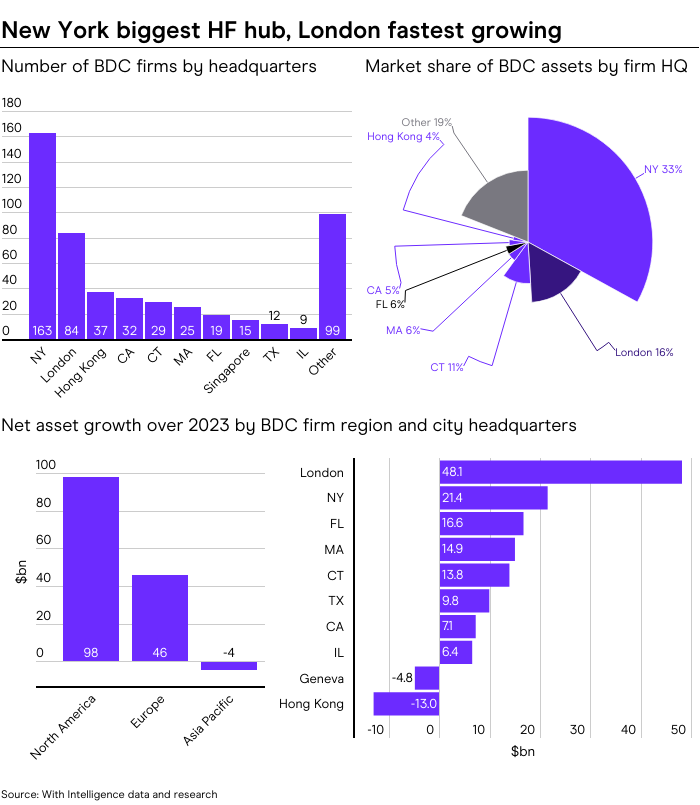

While New York’s dominance as the world’s hedge fund hub remained unchallenged with 163 firms holding one-third of BDC assets, among global hubs, London saw the largest rise in assets ($48bn) across its 84 BDC firms. The UK capital holds a 16% BDC market share by assets.

The Asia region saw a slight net asset decline. Within the region, Hong Kong saw the largest decline in billion-dollar hedge fund assets over 2023, down $3bn, while rival Singapore added nearly $4bn.

Over 2023, there was a net addition of 11 firms to the BDC, including 15 new entries and six new launches.

Among new entrants was Mala Gaonkar’s SurgoCap Partners, which ranked as the biggest launch of the first half and the largest ever debut of a female-led hedge fund, and London-based Ilex Capital, which debuted with around $1.8bn in July.

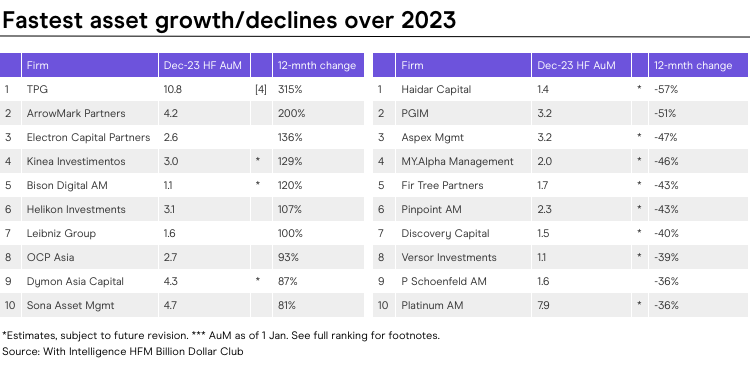

Other notable new entrants include Swiss systematic multi-strategy shop Leibniz Group, which doubled assets to $1.6bn by year-end.

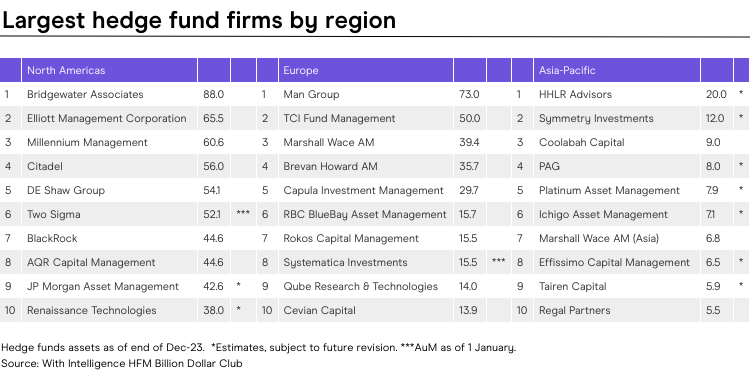

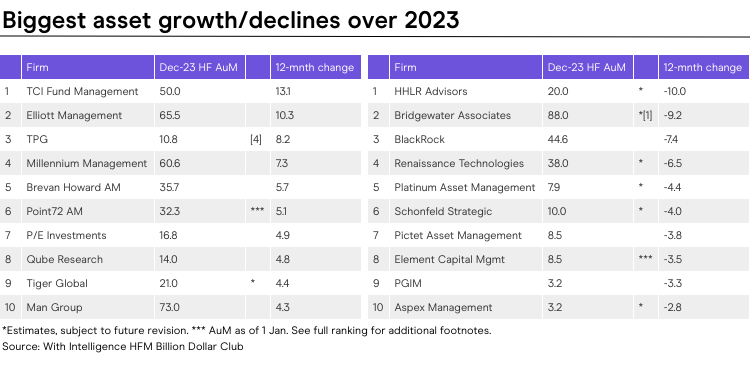

Activists TCI Fund Management and Elliot Management Corporation saw the greatest asset growth over 2023, both adding more than $10bn in AuM after strong performance. TCI posted a 33% gain, its best performance in four years.

Hillhouse, Bridgewater, BlackRock and Renaissance Technologies saw some of the largest asset declines in dollar terms, according to With estimates, while Haidar Capital Management saw the biggest percentage drop, driven by a 43% drop in its macro fund, its worst-ever annual loss.

Bridgewater remains the world’s largest hedge fund firm despite seeing 2023 performance losses in its flagship Pure Alpha Fund. As part of a restructuring announced last March, CEO Nir Bar Dea said the firm would cap assets in the Pure Alpha strategy below its maximum size to “raise the probability of sustained outperformance”.