AI: Beyond the Hype

Equity investors' belief in the transformative power of AI has been giving a boost to long/short equity hedge funds

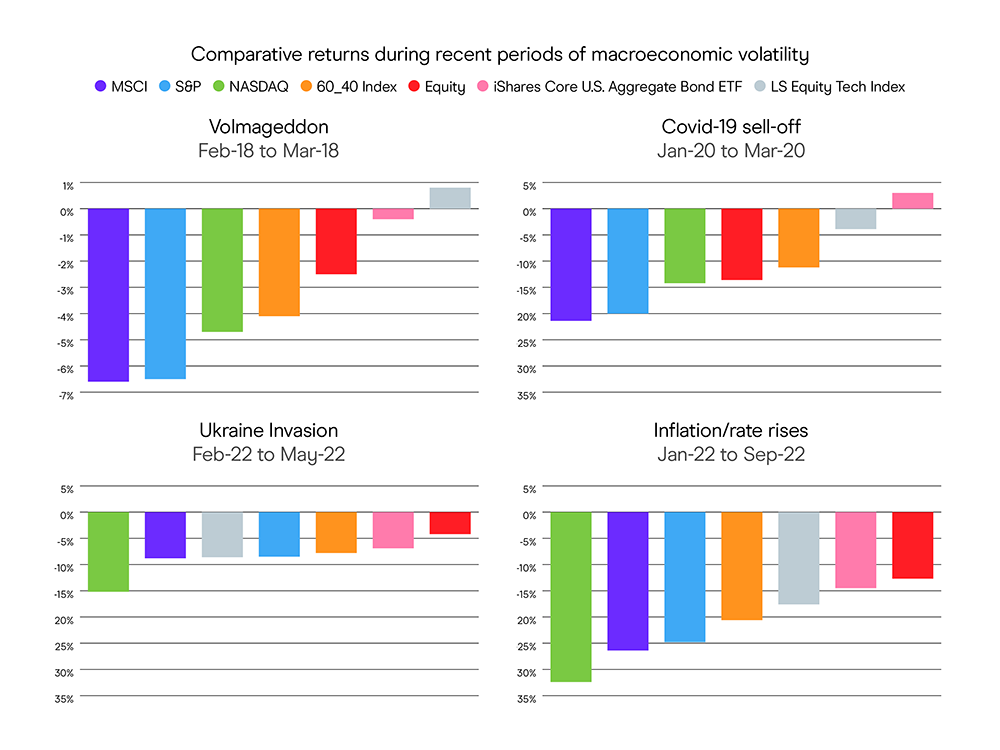

ChatGPT, a chatbot developed by Open AI, captured investor imagination and triggered a phenomenal rally in technology stocks in H1 2023. With Intelligence’s latest hedge fund strategy report, which examined the performance of long/short equity funds in the first half of 2023, showed the strategy has taken a boost from this investor sentiment.Artificial intelligence appeared to be the only game in town for the best part of this year – after an abysmal 2022 for stocks, dragged down by inflation at 20-year highs and unprecedented interest rate increases by the US Federal Reserve and its counterparts, investors piled into technology stocks they thought would benefit most from the spread of AI.

Investors are betting that ChatGPT has ushered in an artificial intelligence era that will lead to a leap in human productivity and transform business and everyday life. Generative AI, the technology ChatGPT is based on, uses large language models to understand and produce human-sounding language to answer questions and assist in composing emails, essays, articles, and code.

“Generative AI will change the way companies use data and any company that does not use generative AI for better insight into their business will be left behind,” Javier Panizo, global consumer analyst and portfolio manager at Nomura Asset Management in London, told With Intelligence. “Generative AI will be a game changer for consumers as well. Generative AI will make enterprises and consumers more productive and will enhance the productivity of the global economy.”

Investors have been buying in to the promise of continued future revenue growth at companies that are in the forefront of AI adoption.

Hedge funds were as eager as investors to jump on the AI bandwagon.

Gains posted by the largest US technology stocks based on optimism that AI applications would boost earnings also helped long/short equity hedge funds, which manage $1.1tn in total, to do better than other strategies in the first half, the With Intelligence Long/Short Equity Hedge Fund Strategy report showed.

The Magnificent Seven

The winners of this year’s AI-propelled equity-market boom – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – have been referred to as the Magnificent Seven, inspired by the 1960s Western movie. And hedge funds investing in these seven biggest US technology companies on the expectation that they will benefit from their push into AI have been instrumental to the US equity market gains this year.

The shares of these seven companies, which all posted deeply negative returns last year, rose more than 90% on average in the first half of the year, helping the S&P500 post a 16% gain and the tech-laden Nasdaq Composite to soar by nearly 32%, its best first-half performance in 40 years.

The best performer among them was Nvidia, with its stock price rising 190% over the period on expected demand for its chips used to train generative AI software like ChatGPT. As the mega-cap tech companies have all entered the AI race, expectations that they will also be big customers of Nvidia contributed to gains in its share price.

Santa Clara, California-based maker of graphics processing units (GPUs) Nvidia reported revenue of $13.51 billion for the three months ended on July 30, more than doubling from $6.7 billion in the same quarter a year earlier. Its diluted earnings per share rose to $2.48 from $0.26 a year earlier.

“A new computing era has begun,” said Nvidia founder and chief executive Jensen Huang in an earnings statement. “Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI. Nvidia GPUs… make up the computing infrastructure of generative AI,” adding that, “The race is on to adopt generative AI.”

The company that is probably taking the biggest bet on AI is Microsoft. It partnered with OpenAI, the company behind ChatGPT years ago and this year it increased its stake. Its investments have reportedly totalled $13 billion it now owns 49% in the AI pioneer. It also moved fast to integrate AI chatbots it calls ‘copilots’ into all its products, from its Bing search engine and Microsoft 365 productivity software to its Azure cloud services platform.

Each of the Magnificent Seven is seeking to benefit from AI technology in its own way.

Alphabet, which dominates internet search with Google, launched its own AI chatbot Bard earlier this year, and it’s planning to integrate it into its search engine. Amazon, the leader in cloud services with its Amazon Web Services unit, said it will invest up to $4bn in cash in AI startup Anthropic, to respond to challenges from in cloud computing from Microsoft and Alphabet. Apple is testing AI applications for Siri, its virtual assistant, and Meta, Facebook’s parent, wants to embed AI in its social networks.

Panizo of Nomura sees Nvidia, Microsoft and Alphabet as the main long-term beneficiaries from generative AI.

“These three companies will be able to monetize generative AI the best in our opinion,” Panizo said. “Nvidia is selling AI chips that provide the infrastructure for generative AI. Microsoft is infusing generative AI capabilities called Copilot into applications like Office, as well as allowing their Azure customers to combine their proprietary data with ChatGPT for business analytics.” He added that the investment case for Alphabet was “better engagement with search results by embedding Bard with their traditional search, which will lead to higher ad prices.”

Hedge funds hold record exposure to the seven biggest tech stocks by market capitalization, according to Goldman Sachs analysis. These seven stocks collectively made up some 20% of the total net market value held by hedge funds.

AI: powering performance?

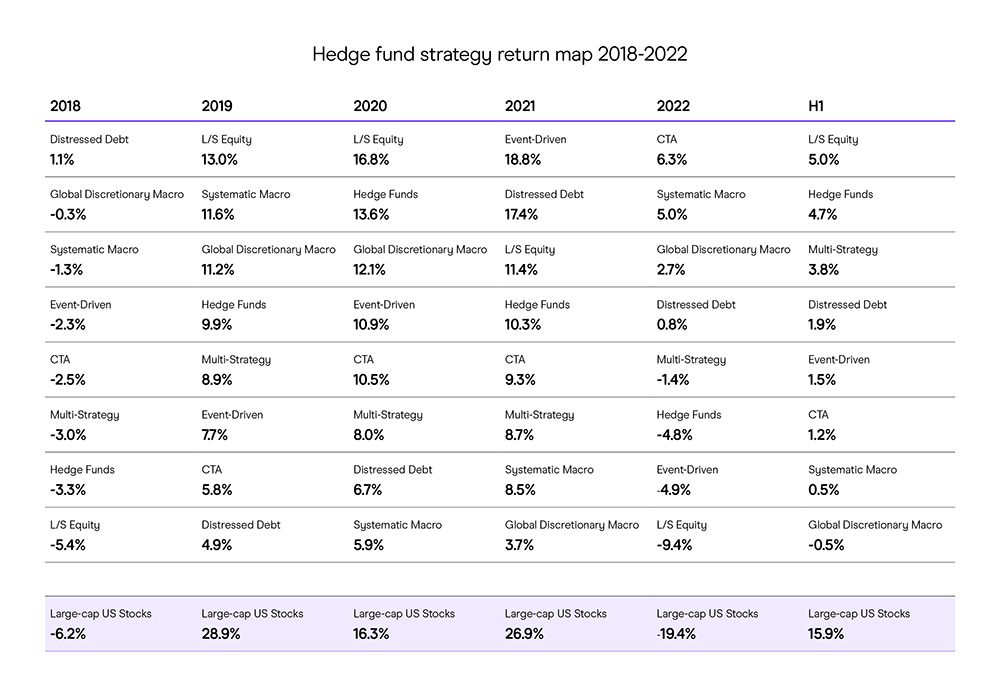

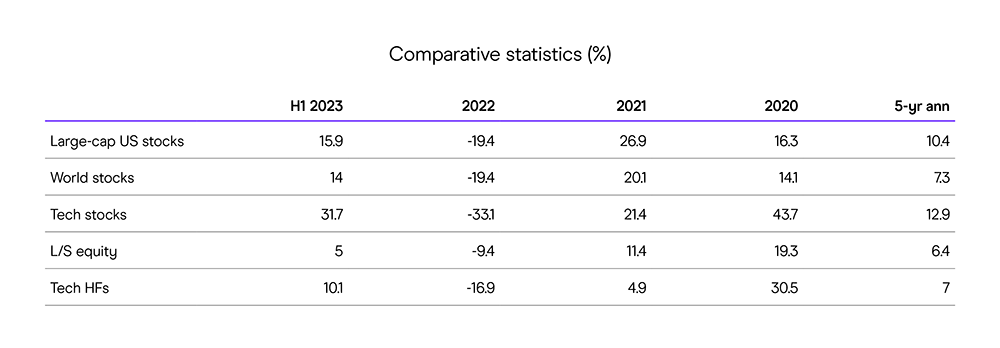

Long/short equity was the leading hedge fund strategy over the first half (5%) with its best performance since H1 2021 amid a rally in US stocks, driven by accelerated AI adoption and prospective productivity gains, and stronger than expected US economic performance, our report shows.

Long/short equity funds account for about a third of all assets invested with hedge funds.

Taking long positions in shares that they believe to be underpriced and short selling the ones that appear to be overvalued worked to managers’ advantage in H1 2023. Long/short equity funds posted a 5% return in the first half of this year, rebounding from an annual loss last year, when they finished at the bottom of the strategy return table. Their H1 returns beat the 3.9% posted by multi-strategy funds and the 1.9% return achieved by following a distressed debt strategy, according to the report, which was compiled from performance data With Intelligence collected from hedge funds.

Within long/short equities, tech-focused hedge funds were the biggest winners in the first six months of 2023, returning 10.1%, probably further testament to the positive contribution from the gains by technology shares on the back of the AI enthusiasm.

Tech-stocks: safe haven?

The better relative performance – more limited negative returns – can possibly be put down to the fact that the tech-focused hedge funds are more heavily invested in ‘growth’ stocks and large-cap technology, media and telecom stocks, the likes of Apple, Amazon, Alphabet, Microsoft and Meta, which have acted as a safe haven in tough times for equities, according to the report.

Subscribers:

Read our Long/Short Equity Hedge Fund Strategy report and track technology within long/short equity hedge fund strategy performance using our platform data