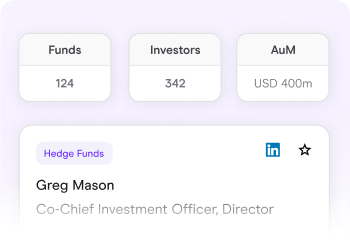

Hedge fund data

Our hedge fund coverage includes profiles on investors, consultants, managers, funds, searches, and people.

0

Investors0

Consultants0

Managers0

Active Funds0

Searches0

PeopleLatest hedge fund insights

Assessing Global Single Family Office Numbers

The hard task of assessing SFO numbers nationally or globally

7 Things to Consider When Implementing a CRM

44% unhappy with their current CRM

Global Family Offices Are Set to Double by 2026

The GFO market size sits at $5.32trn and is expected to double by 2026

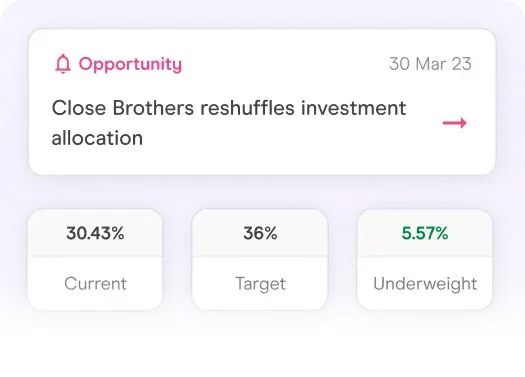

Smarter decisions. Richer connections.

Our data, intelligence and networking events will help you get ahead. Connecting you with the people and data you need for more efficient fundraising, asset allocation and fund servicing.